Every month, financial teams race against time – reconciliations, approvals, and reports! The month-end close can often feel like Groundhog Day, with teams working overtime to process hundreds of invoices, match countless transactions, and catch any unusual entries before they become problems.

Today’s businesses can’t afford to operate in monthly cycles anymore.

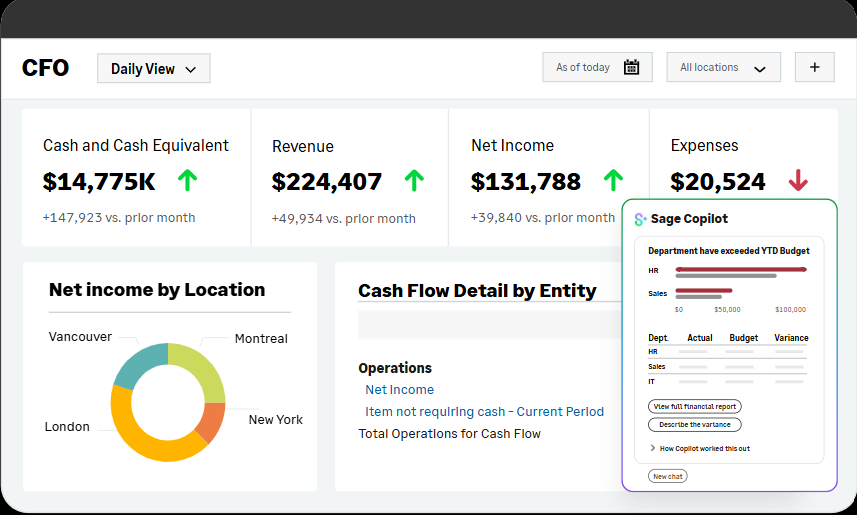

That’s why Sage Intacct, one of the leading cloud financial management systems, has been incorporating AI features into their platform. With additions like Sage Copilot and GL Outlier Assistant, the company hopes to help finance teams break free from the monthly close trap and move toward continuous, real-time financial management.

In this guide, I will take you through Sage’s different AI features and how to expand Sage’s AI capabilities.

Sage Intacct AI: Native features explained

The future of accounting isn’t about faster monthly closes. The focus is gradually shifting to eliminating closing cycles. At least this has been the driving force behind Sage’s recent updates.

The aim is to have AI constantly monitor your financial data, catching issues before they become problems and automating routine tasks in real-time. More of continuous accounting rather than periodic sprints.

Let me walk you through Sage’s native AI features:

1. GL Outlier Assistant

It is an AI-powered system that monitors transactions in your general ledger for anomalies and potential errors. The idea is to prevent errors from impacting financial statements by catching them at entry, rather than during month-end reconciliation.

How it works:

- Reviews transactions against historical patterns

- Uses customizable thresholds based on business rules

- Routes suspicious entries back to those who submitted it

- Learns from corrections to improve accuracy

For example, if you mistakenly enter a monthly supply charge of $500 as $5,000, the system flags it immediately for correction, preventing downstream reconciliation issues.

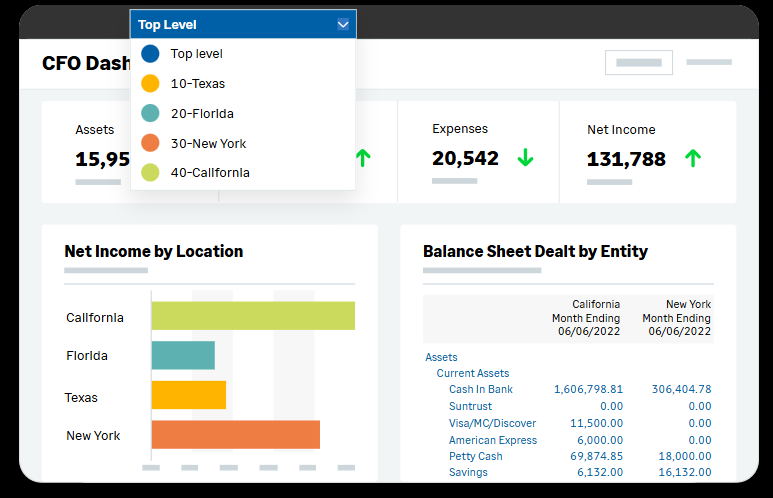

2. Sage Copilot

Some of you would have used Microsoft’s Copilot or at least seen it. Well, now Sage too has a Copilot. It is basically an AI assistant that automates financial analysis, reporting, and routine tasks. It hopes to reduce time spent on manual financial analysis and report creation.

You can use it to:

- Compare budgeted versus actual figures in real-time

- Get quick answers to financial queries through conversational search

- Streamline month-end close processes

- Automate approval workflows and reconciliations

Say you need to check budget variances for this quarter. Now you can simply ask Sage Copilot to give you the differences between budgeted and actual figures. You can go a step further and ask where the significant variances are. It will help you drill down into specific transactions.

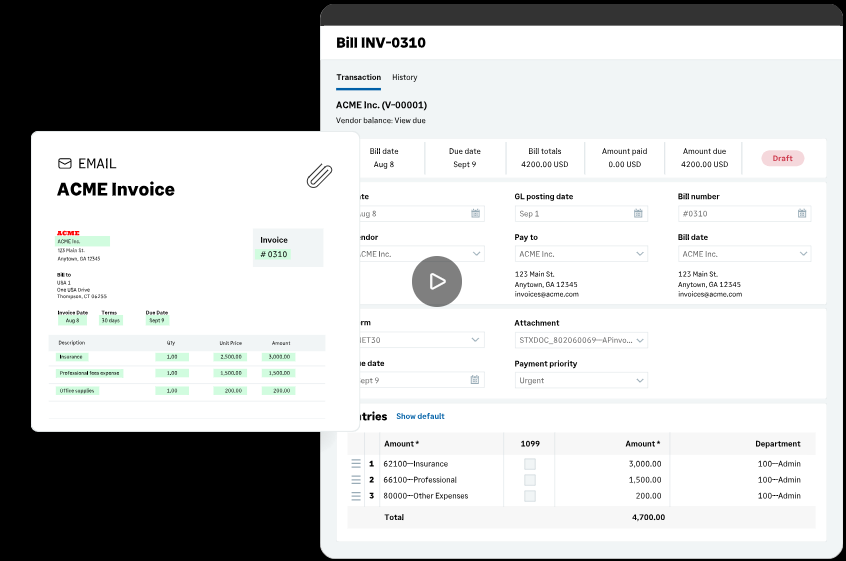

3. AP bill automation

This is Sage’s native solution for handling invoices. It aims to reduce the time your team spends on manual data entry and invoice processing.

How it works:

- Upload bills directly or forward them to a dedicated email address

- System creates draft bills using AI to extract invoice data

- Matches information against your chart of accounts

- Routes bills through your approval workflow

- Posts approved bills automatically to your GL

For example, when you receive an invoice via email, you can forward it to your dedicated Sage email address. The system reads the invoice, creates a draft bill with the vendor details, amount, and line items already filled in. You just need to review the details and approve.

Now these native AI features from Sage Intacct may help you take first steps toward continuous accounting. However, you may soon find out that you need more comprehensive automation. They work well for basic invoice processing and anomaly detection, but handling complex AP workflows, managing multiple input sources, or dealing with varied document formats often requires additional capabilities.

This is where integration solutions like Nanonets come in. Let me show you how to expand Sage’s AI capabilities to handle more complex financial workflows.

[Image source: Sage’s official website]

How to expand Sage’s AI capabilities

Nanonets is an Intelligent Document Processing platform that integrates directly with Sage Intacct. While Sage’s native features handle basic automation, Nanonets takes it further by processing any type of financial document and establishing automated workflows.

Let me show you how Nanonets AI can help expand your automation capabilities:

1. Automated document import

The first challenge in any AP process is document intake. Nanonets offers many upload options, allowing you to automatically process and upload extracted data to Sage Intacct.

- Automatically captures invoices from email inboxes

- Monitors specific folders in Google Drive, Dropbox, or your internal systems

- Accepts any document format — PDFs, JPGs, PNGs, scanned documents, and handwritten documents

- Handles multiple document types — invoices, purchase orders, receipts, packing slips

You can even use API integrations to automatically feed documents from your existing systems directly into the processing workflow. This ensures all financial documents are captured and processed consistently, regardless of their source or format.

2. Intelligent data extraction and processing

Once documents are in the system, the next step is data extraction. This is where Nanonets’ advanced AI-OCR capabilities come into play.

You get to choose between different AI models based on your needs:

- Zero-shot models that work immediately without training

- Instant Learning models that adapt to your corrections in real-time

- Pre-built models for standard documents like invoices

- Custom models for unique document types or specific requirements

You can customize how the AI reads your documents by providing clear descriptions for each field. For example, instead of simply labeling a field as “invoice_number”, you can specify “A unique alphanumeric identifier located at the top right, starting with ‘INV-‘ followed by 8 digits.”

The system offers sophisticated data extraction:

- Extracts data from any document with high accuracy, regardless of format or structure

- Processes both single-value fields (like invoice numbers) and repeating data (like line items)

- Recognizes and matches vendor details with your Sage records automatically

- Learns from user corrections to continuously improve accuracy

- Validates extracted data against predefined rules and flags discrepancies

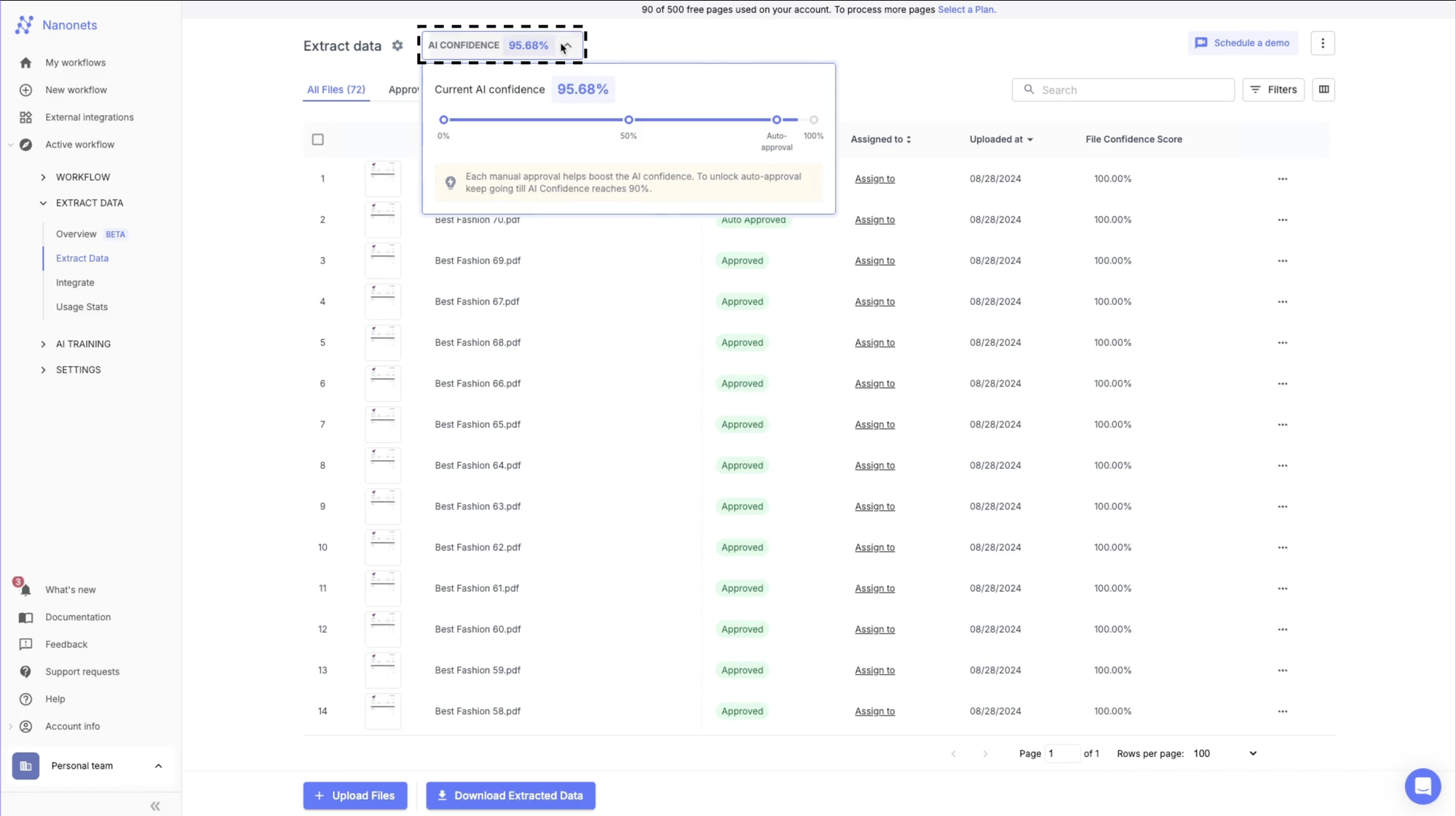

In the above GIF, you can see how the AI instantly extracts standard fields and matches vendor names against your Sage vendor list. You also get a dropdown to verify or adjust matches when needed.

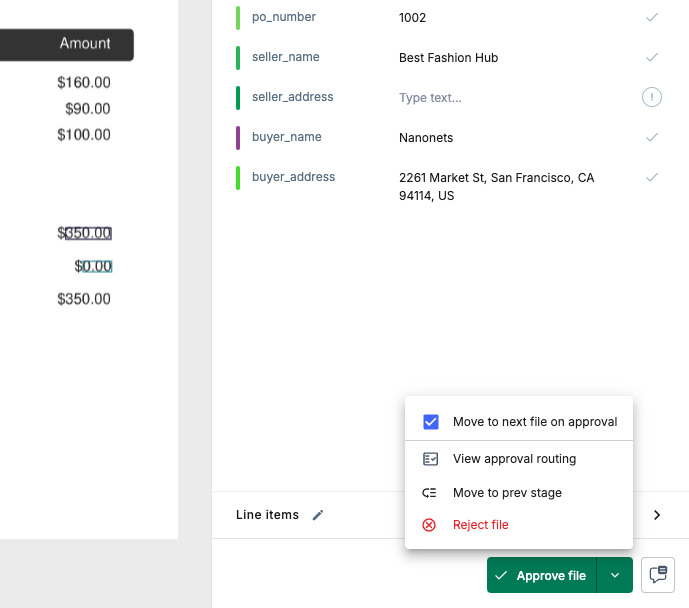

For line items, it captures all details in structured tables and automatically maps each line to your Sage GL accounts. You can review and adjust these mappings through dropdowns, ensuring your data is validated before it reaches your accounting system.

The AI model builds understanding through context, not just text recognition. When processing an invoice, it:

- Distinguishes between different address types (billing vs shipping)

- Separates header information from line items

- Recognizes various tax categories and calculations

- Maintains relationships between related data points

The system also tracks AI confidence levels, showing you exactly how reliable the extraction is for each document. This helps you decide which documents need manual review and which can be processed automatically.

3. Automated GL coding and matching

Manual coding of transactions and matching documents against purchase orders are often tasks that no AP teams look forward to. They can be time-consuming and error-prone. This is where Nanonets’ intelligent matching capabilities make a significant difference.

The system streamlines coding and matching through:

- Automatic GL code suggestions

- Smart matching between invoices, POs, and receipts

- Real-time validation against your business rules

- Custom routing for exceptions and discrepancies

- Continuous learning from your team’s corrections

You can set up different validation rules based on your needs, like:

- Match line items individually for detailed reconciliation

- Compare total amounts for quick validation

- Check specific fields like tax rates or payment terms

- Flag mismatches above certain thresholds

The impact can be significant. It can reduce processing time, save time, reduce error rates, and dedicate more time to exception handling. The system also maintains a complete audit trail of all matches and exceptions, making it easier to track issues and demonstrate compliance during audits.

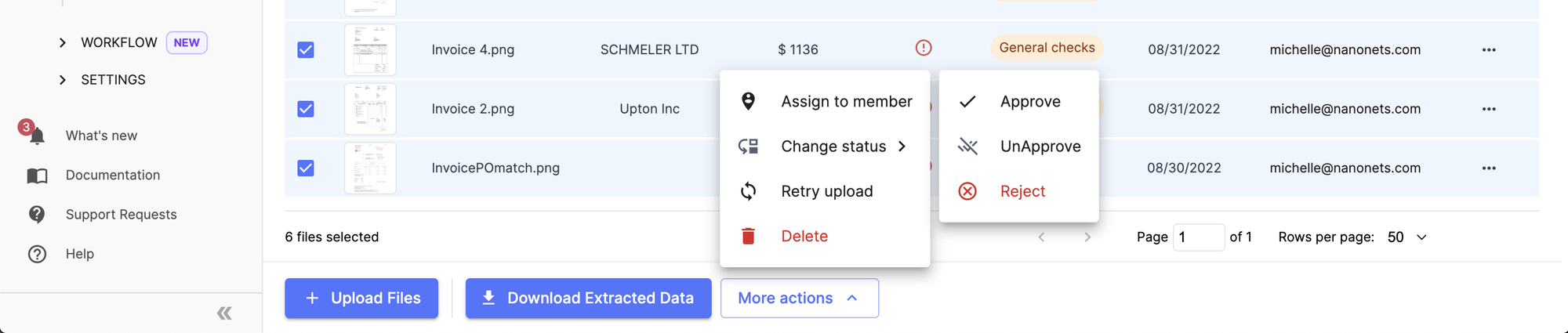

4. Approval workflows

Getting invoices approved is often where bottlenecks occur. You might have vendors chasing payments while invoices sit in someone’s inbox waiting for approval. Nanonets addresses this through intelligent workflow automation.

The system handles approvals through:

- Custom routing rules based on amount, vendor, or department

- Multi-channel notifications (email, Slack, Teams)

- One-click approvals from any device

- Automated reminders for pending items

- Real-time visibility into approval status

You can set up approval workflows that match your business needs. For example:

- Route invoices over $10,000 to senior management

- Send IT purchases to your IT team first

- Require multiple approvals for specific vendors

- Set up parallel approvals for faster processing

The system maintains a complete audit trail of who approved what and when, making it easy to track responsibility and ensure compliance with your approval policies.

5. Getting your data into Sage Intacct

Once documents are processed and approved, you need to get this data into Sage. Nanonets offers multiple ways to export your processed data:

- Download as CSV files for custom reporting

- Use APIs for custom workflow integration

- Direct sync with Sage

- Automated data compilation based on your rules

The Sage Intacct-Nanonets dedicated integration enables you to:

- Create bill records automatically

- Sync vendor information in real-time

- Maintain consistent coding across systems

- Provide detailed sync status updates

- Use partner SenderID for seamless connectivity

The platform is designed for finance teams to manage independently, without requiring technical expertise.

Looks good on paper? Well, let me share a real example of how a company transformed their AP processes using Nanonets’ AI-powered workflows.

Asian Paints, a leading manufacturer of paints and coatings, automated their entire AP workflow using Nanonets. Before automation, their AP team spent hours manually processing invoices, matching documents, and updating their accounting system. Each document took about 5 minutes to process, and errors were common despite their best efforts.

After implementing intelligent automation:

- Processing time dropped to 30 seconds per document

- Teams saved 192 hours monthly

- Accuracy improved significantly

- Staff could finally focus on strategic tasks

- Customer satisfaction reached 8/10

The system starts delivering value immediately with Zero Shot models, while Custom and Instant Learning models improve accuracy over time as they learn from your corrections.

What to do next? If you’re looking to cut your invoice processing time and save hours on AP tasks, you can schedule a personalized demo with us. We’ll show you exactly how Nanonets fits into your specific Sage Intacct workflows and help automate your AP process end-to-end.